3D printing is no longer specialist equipment

McDonald’s Happy Meal Toys to medical materials – 3D printing is no longer specialist equipment – it’s been described as ushering in the new industrial revolution, giving consumers the ability to create customised goods at an affordable price. However, this poses some challenges to the insurance industry.

GB’s General Manager – Specialty Markets, Peter Tomkins explores these.

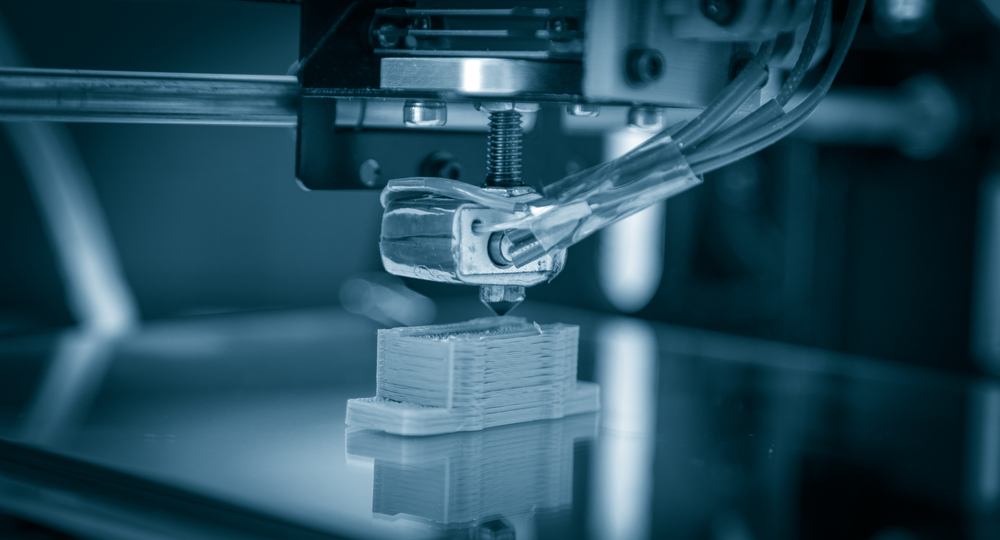

So what is 3D printing and how does it work? 3D printing uses a virtual design file to create a tangible copy of the design. 3D printing technology creates products layer by layer, using materials like plastics, metals and even human tissue. Use of 3D printing for medical materials like prosthetics and even veins and organs is growing. One Chinese construction company printed a one-storey home in under a day.

“Although mostly used in the automotive and aerospace industries, 3D printers are changing the manufacturing process and raising questions about liability. For example, while manufactures are traditionally liable for product defects, is failure in 3D printing attributed to corrupt files, defective printer or human error? Does the owner of the printer technically become the manufacturer?”

Tomkins states that these claims would be analysed as isolated case by case incidents, as the fault in the supply change will vary between cases.

Insurance implications with the growing popularity of 3D printers include complexity of deciding on the parties responsible for defects and multi-jurisdictional issues stemming from virtual design file sharing.

“Other risks include worker’s compensation claims, intellectual property challenges and the prominence of cyber risks to businesses.”

Tomkins also mentioned there will be a need for careful assessment from a product liability perspective.

“Other than ascertaining liability, there could be an increase in risk insured depending on the process and consideration as to whether risks at each stage of the process will need to be mitigated.”

Tomkins mentioned that insurers needed to consider regulatory developments.

“Keeping up to date with 3D printing regulations can ensure compliance and limit the costs of potential defence litigations.”

As 3D printing grows, so too will the risks.